Can You Deduct In Kind Donations . for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. Let’s walk through a few examples to. Find forms and check if the group you contributed to. you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. your charitable contributions may be deductible if you itemize. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized.

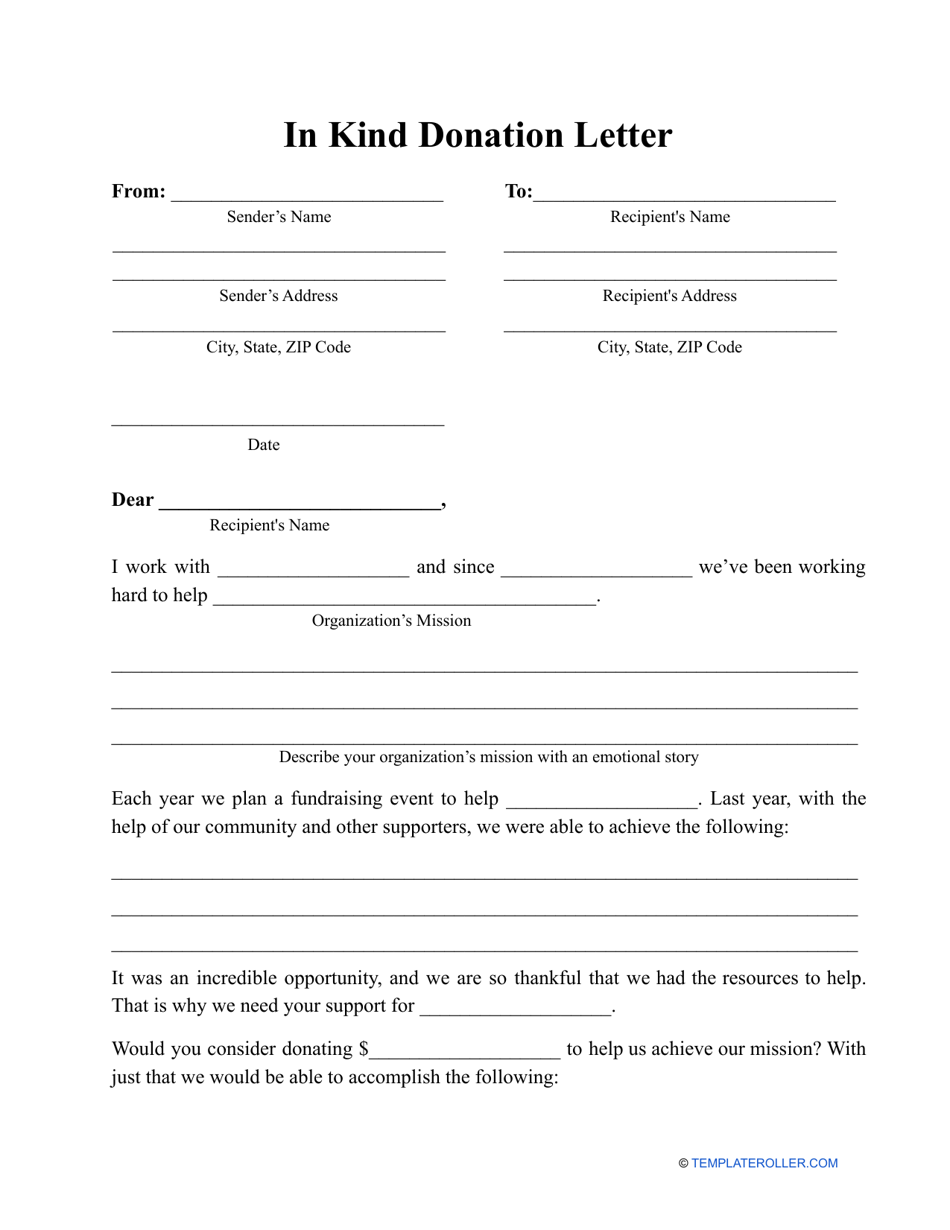

from www.templateroller.com

generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. Find forms and check if the group you contributed to. for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. Let’s walk through a few examples to. your charitable contributions may be deductible if you itemize. you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction.

In Kind Donation Letter Template Download Printable PDF Templateroller

Can You Deduct In Kind Donations you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. Let’s walk through a few examples to. your charitable contributions may be deductible if you itemize. Find forms and check if the group you contributed to. you may deduct charitable contributions of money or property made to qualified organizations if you itemize your.

From www.slideshare.net

In Kind Donation Form Can You Deduct In Kind Donations Let’s walk through a few examples to. your charitable contributions may be deductible if you itemize. Find forms and check if the group you contributed to. for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. you may deduct charitable contributions of money or property made to. Can You Deduct In Kind Donations.

From cullinanelaw.com

How do charitable donations affect my taxes? Can You Deduct In Kind Donations generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. Let’s walk through a few examples to. your charitable contributions may be deductible if you itemize. charitable contributions or. Can You Deduct In Kind Donations.

From www.youtube.com

Do donations inkind qualify for 80G deduction? YouTube Can You Deduct In Kind Donations for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. Find forms and check if the group you contributed to. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. your charitable contributions may be deductible if you itemize. generally,. Can You Deduct In Kind Donations.

From www.tffn.net

How Much Can I Deduct for Clothing Donations in 2021? The Enlightened Can You Deduct In Kind Donations for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. Find forms and check if the group you contributed to. you may deduct charitable contributions of money or property made to. Can You Deduct In Kind Donations.

From www.patriotsoftware.com

Charitable Donation Deduction A Stepbystep Guide Can You Deduct In Kind Donations Let’s walk through a few examples to. your charitable contributions may be deductible if you itemize. generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. Find forms and check if the group you contributed to. you may deduct charitable contributions of money or property made to qualified organizations if. Can You Deduct In Kind Donations.

From donorsnap.com

InKind Donations A Complete Guide DonorSnap Can You Deduct In Kind Donations your charitable contributions may be deductible if you itemize. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. Find forms and check if the group you contributed to. you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. generally, you can only. Can You Deduct In Kind Donations.

From www.anyrgb.com

Gifts In Kind, tax Deduction, fundraising, Charitable organization Can You Deduct In Kind Donations charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. Find forms and check if the group you contributed to. Let’s walk through a few examples to. your charitable contributions may be deductible if you itemize. generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form. Can You Deduct In Kind Donations.

From amynorthardcpa.com

Can I deduct donations of my time to charitable organizations? Amy Can You Deduct In Kind Donations generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. Let’s walk through a. Can You Deduct In Kind Donations.

From www.marca.com

Charitable donation tax deduction How much can yo actually deduct? Marca Can You Deduct In Kind Donations charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. your charitable contributions. Can You Deduct In Kind Donations.

From dxoetmuwc.blob.core.windows.net

In Kind Donation Tax Write Off at Edith Flores blog Can You Deduct In Kind Donations generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. your charitable. Can You Deduct In Kind Donations.

From www.washingtonpost.com

How eligible seniors can deduct charitable donations The Washington Post Can You Deduct In Kind Donations you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. your charitable contributions may be deductible if you itemize. Find forms and check if the group you contributed to. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. generally, you can only. Can You Deduct In Kind Donations.

From dxoetmuwc.blob.core.windows.net

In Kind Donation Tax Write Off at Edith Flores blog Can You Deduct In Kind Donations Find forms and check if the group you contributed to. generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. charitable contributions or donations can help taxpayers to lower their taxable income via. Can You Deduct In Kind Donations.

From www.pinterest.com

If you receive something in return for donating you can deduct only the Can You Deduct In Kind Donations Let’s walk through a few examples to. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. Find forms and check if the group you contributed to. for giving money, goods, or property to. Can You Deduct In Kind Donations.

From www.gracedinc.com

InKind Donation Form GRACED, Inc. Durham, NC Can You Deduct In Kind Donations generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. your charitable contributions may be deductible if you itemize. Find forms and check if the group you contributed to. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. you may deduct charitable. Can You Deduct In Kind Donations.

From www.youtube.com

Can I deduct donations of my time to charitable organizations? YouTube Can You Deduct In Kind Donations Find forms and check if the group you contributed to. Let’s walk through a few examples to. charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. for giving money, goods, or property to. Can You Deduct In Kind Donations.

From www.finansdirekt24.se

Charitable Donation Deduction A Stepbystep Guide finansdirekt24.se Can You Deduct In Kind Donations Find forms and check if the group you contributed to. generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. Let’s walk through a few examples to. your charitable contributions. Can You Deduct In Kind Donations.

From www.uslegalforms.com

InKind Donation Fill and Sign Printable Template Online US Legal Forms Can You Deduct In Kind Donations you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. Find forms and check if the group you contributed to. for giving money, goods, or property to certain types of organizations, the irs allows you to take a tax deduction. your charitable contributions may be deductible if you itemize. . Can You Deduct In Kind Donations.

From www.templateroller.com

In Kind Donation Letter Template Download Printable PDF Templateroller Can You Deduct In Kind Donations you may deduct charitable contributions of money or property made to qualified organizations if you itemize your. Find forms and check if the group you contributed to. your charitable contributions may be deductible if you itemize. generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized. charitable contributions or. Can You Deduct In Kind Donations.